pay personal property tax richmond va

Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes.

1404 Park Ave Richmond Va 23220 Realtor Com

Or stop by without an appointment on Tuesdays Wednesdays Thursdays and Saturdays in offices with.

. Please call the office for details 804-333-3555. Monday - Friday 800 am - 430 pm Phone Hours. Pay by Phone Pay Personal Property Tax Real Estate Tax Parking Tickets or Public UtilitiesStorm Water bills with a major credit card 25 fee or 100 whichever is greater.

View Bill Detail Screen. Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number. Pay online through Paymentus or.

Personal Property taxes are due on June 5th annually. Proration of personal property tax. Schedule one time or periodic automatic payments with Flex-Pay.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Yearly median tax in Richmond City.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Pay another PP Bill. To mail your tax payment send it to the following address.

When you use this method to pay taxes please make a separate payment per tax account number. Monday - Friday 900 am - 300 pm Physical Address 1300 Courthouse Road 2nd Floor Stafford VA 22554-1300 Mailing Address PO Box 98 Stafford VA 22555. If the information shown is incorrect press the Return to Search button and return to the Pay Real Estate Taxes Online screen.

Personal Property Tax Rate. Pay personal property tax richmond va. Does the leasing company pay the tax without reimbursement from the individual.

Pay bills or set up a payment plan for all individual and business taxes. Supplement bills are due within 30 days of the bill date. Make tax due estimated tax and extension payments.

The Treasurers Office has several ways you can pay. Personal Property Tax bills are white in color with blue boxes and are mailed at least 30 days prior to the due date. Personal Property Tax Relief.

City of richmond 2019 and newer property taxes real estate and personal property are billed and collected by the ray county collector. When do I need to file a personal property return for my car or pickup. Tax Pay My Way.

For Additional Information Including Delinquent BPOL Taxes Please Contact Us at. Personal property taxes are due May 5 and October 5. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value.

Tax Rate The Personal Property tax rate for 2021 is 4 per 100 of assessed value. Be it property taxes utility bills tickets or permits and licenses you can find them all on papergov. Personal Property Tax.

The assessment on these vehicles is determined by the Commissioner of the Revenue. Portsmouth levies a personal property tax on vehicles boats aircraft and mobile homes. Emailed receipts provide electronic payment history without the paper.

You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. When a person initially acquires an automobile or truck andor moves that vehicle into Henrico County that person must file a personal property return.

Sign up for eBills. Pay via the Treasurers Local Payment Call Center at 757 385-8968. Make an appointment to visit us on Mondays and Fridays.

To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button. Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA value at a rate of 500 per 10000. Is more than 50 of the depreciation.

540 658-4120 Email Live Chat Office Hours. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. Box 27412 Richmond VA 23269.

Pay Personal Property Taxes Online in City of Richmond seamlessly with papergov. Your tax account number which is located in the upper right corner of each tax statement. A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles.

Call 18333391307 18333391307 Individual income tax bills - choose Individual Bill Payments Business tax bills - choose Business Bill Payments Have your 5-digit bill number and Virginia Tax account number ready. Personal Property Staff Phone. A service fee is added to each payment you make with your card.

Richmond County Treasurers Office. Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes. This bill will contain only the current year taxes due.

View important dates for current supplements and due dates. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. The governing body of any county city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles trailers semitrailers and boats which have acquired a situs within such locality after the tax day for the balance of the tax year.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. If you have any delinquent taxes due on that account the message shown below will appear on your bill. You can pay your personal property tax through your online bank account.

Personal Property Taxes are due semi-annually on June 25th and December 5th. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

3121 Stony Point Rd Unit Uc Richmond Va 23235 Realtor Com

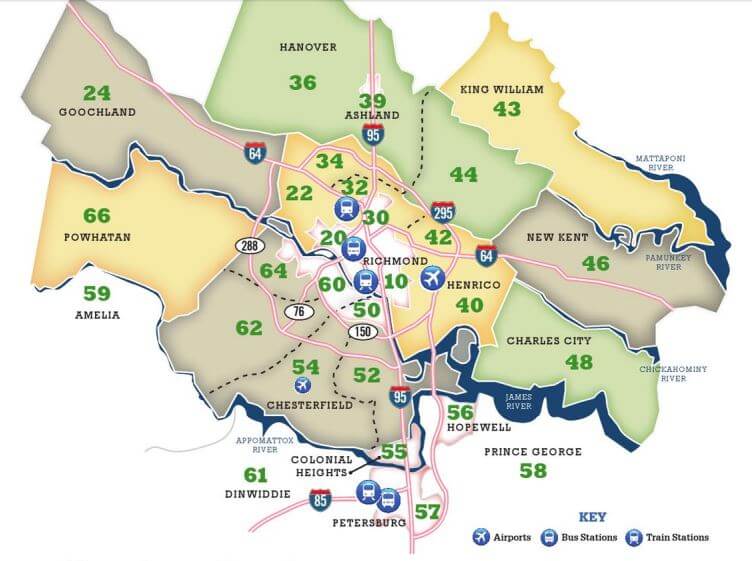

Guide To Richmond Area Mls Real Estate Zones Mr Williamsburg

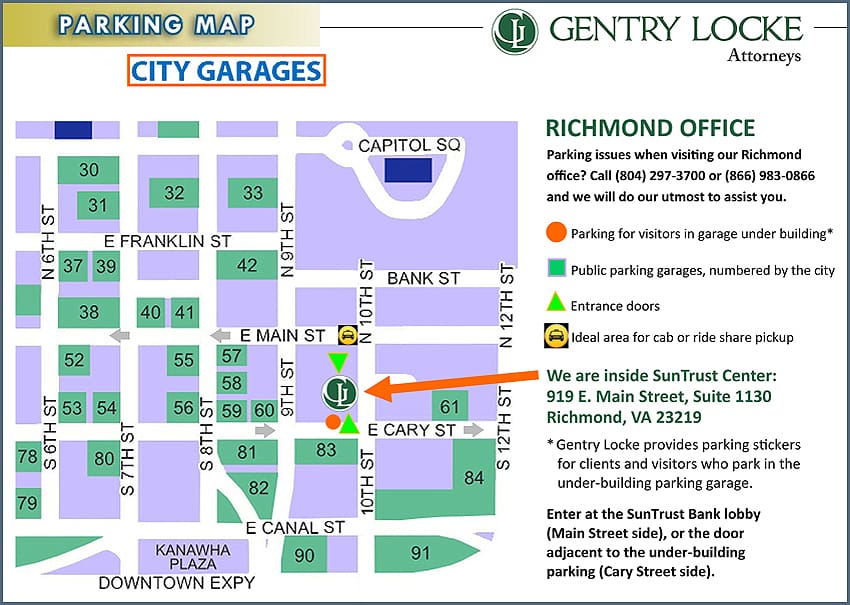

Visiting Our Richmond Office Gentry Locke Attorneys

504 N 26th St Richmond Va 23223 Realtor Com

Bankruptcy Lawyer Richmond Va Tax Attorney Attorneys Intellectual Property Law

4539 Brook Rd Richmond Va 23227 Mls 2113381 Redfin

2700 Monument Ave Richmond Va 23220 Realtor Com

2021 Best Places To Buy A House In Richmond Area Niche

1 W Main St Richmond Va 23220 Realtor Com

605 Maple Ave Richmond Va 23226 Realtor Com

Experts Pull Documents Money From Lee Statue Time Capsule Wavy Com

3114 Grayland Ave Richmond Va 23221 Realtor Com

2700 Elora Rd Richmond Va 23223 Realtor Com

Richmond Va Land For Sale Real Estate Realtor Com

6315 Kensington Ave Richmond Va 23226 Realtor Com

4704 Steeple Ln Richmond Va 23223 Realtor Com

The Next Big Thing Richmond Free Press Serving The African American Community In Richmond Va